Precision in Every Penny: Trust Reliable Financial Solutions

Are you tired of the stress and inefficiency of month-end financial close processes? Discover how our innovative BPA solutions can revolutionize your month-end operations and drive financial success. Let’s empower your finance team to achieve greater efficiency and accuracy.

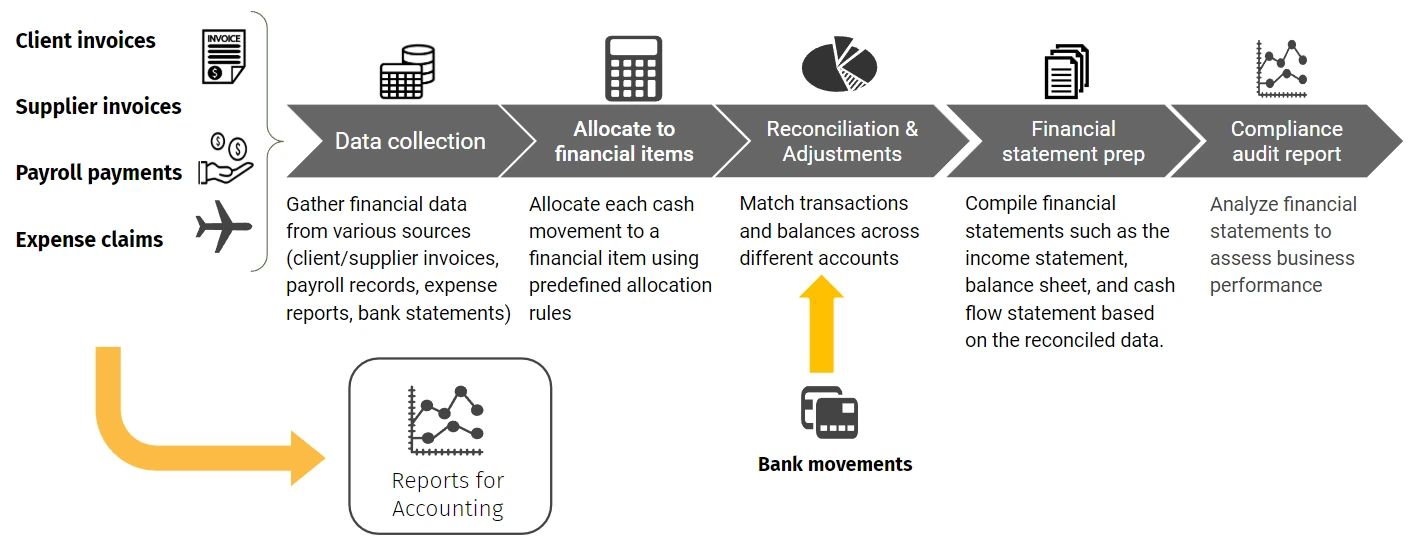

Steps in month end

Month-end processes refer to the series of tasks and activities undertaken by finance departments to close out financial records and prepare financial statements at the end of each accounting period. These processes are critical for ensuring the accuracy of financial reporting, compliance with regulatory requirements, and providing insights into the financial health of the organization.