Accelerate Your Financial Journey

Say goodbye to tedious paperwork, lengthy approval times, and manual errors. With intelligent automation, you can accelerate decision-making, enhance customer satisfaction, and stay ahead in the competitive banking landscape.

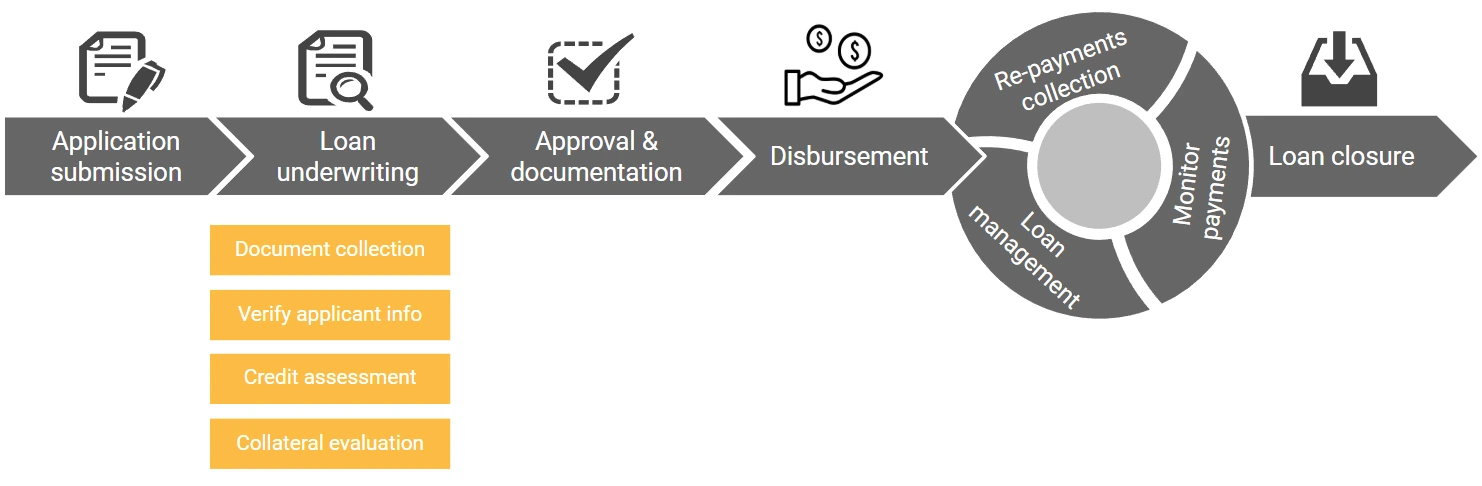

Understanding the process

Loans Processing is the essential procedure through which financial institutions evaluate, approve, and disburse loans to borrowers, facilitating their financial goals and aspirations. It involves meticulous assessment of loan applications, verification of borrower credentials, and adherence to regulatory standards.

Steps in the process