Real-Time Trading, Real Results

In the fast-moving world of financial markets, direct access trading approval is a critical process for financial institutions to ensure that clients meet internal standards and comply with regulations. At Automize Infinity, we help financial institutions optimize their approval process through Business Process Automation.

Understanding the process

Direct Access Trading Approval is the process that financial institutions use to review and approve client requests to have direct access trading accounts.

Direct Access Trading allows traders to access financial markets directly through a trading platform without the intervention of brokers or market makers. This method significantly reduces the time it takes to place orders and enhances the overall efficiency of trading. By connecting directly to the exchange, traders can execute transactions at faster speeds, benefiting from lower latency and more control over their trades.

For financial institutions, enabling direct access trading enhances client satisfaction and helps meet the demands of professional traders who require real-time information and low-latency executions.

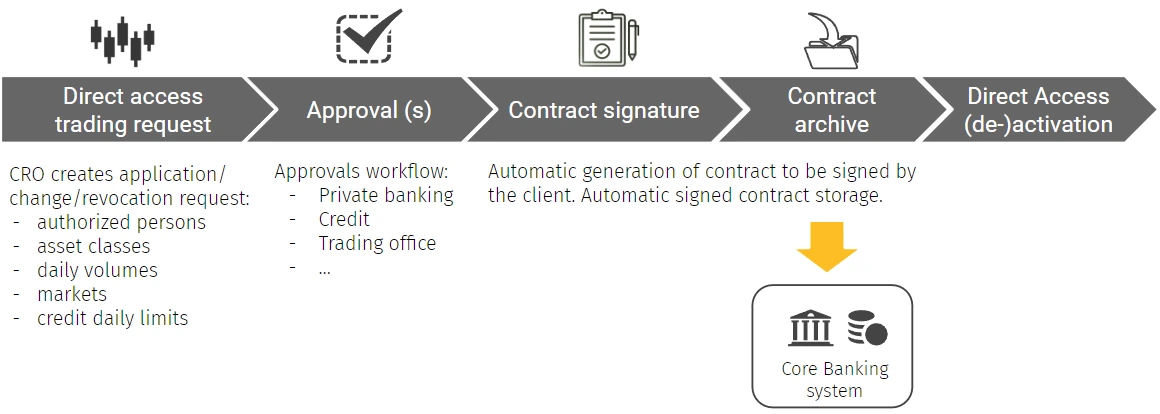

Steps in the process

How can automation improve your process?

By leveraging automation, you can streamline your trading approval process, reduce delays, and stay ahead of the competition.