Handle your Corporate Action Events with Precision

Handle corporate action events such as dividends, mergers, acquisitions, stock splits, and other corporate actions affecting securities held by bank customers with the maximum precision thanks to automation.

What are corporate action events?

Corporate Action Events refer to significant events initiated by a publicly traded company that can impact its shareholders or the securities they hold. These events include mergers and acquisitions, stock splits, dividends, rights issues, and other corporate restructuring activities. For banking institutions, managing corporate action events is crucial for staying informed, making informed investment decisions, and ensuring compliance with regulatory requirements.

Mandatory corporate action events

These are corporate actions that companies are required by law or regulation to execute, typically without any shareholder input or choice. These events can include actions like stock splits, reverse stock splits, mergers, acquisitions, and dividend distributions. Shareholders usually have no discretion in these events, and they must comply with the changes imposed by the company or regulatory authorities.

Voluntary corporate action events

Voluntary corporate actions are initiated by the company and often provide shareholders with a choice or decision to make. Examples of voluntary corporate actions include tender offers, rights issues, share buybacks, and dividend reinvestment programs. Shareholders have the option to participate in these events based on their preferences and investment strategies. While participation in voluntary events is not mandatory, shareholders may choose to take advantage of the opportunities presented by these actions.

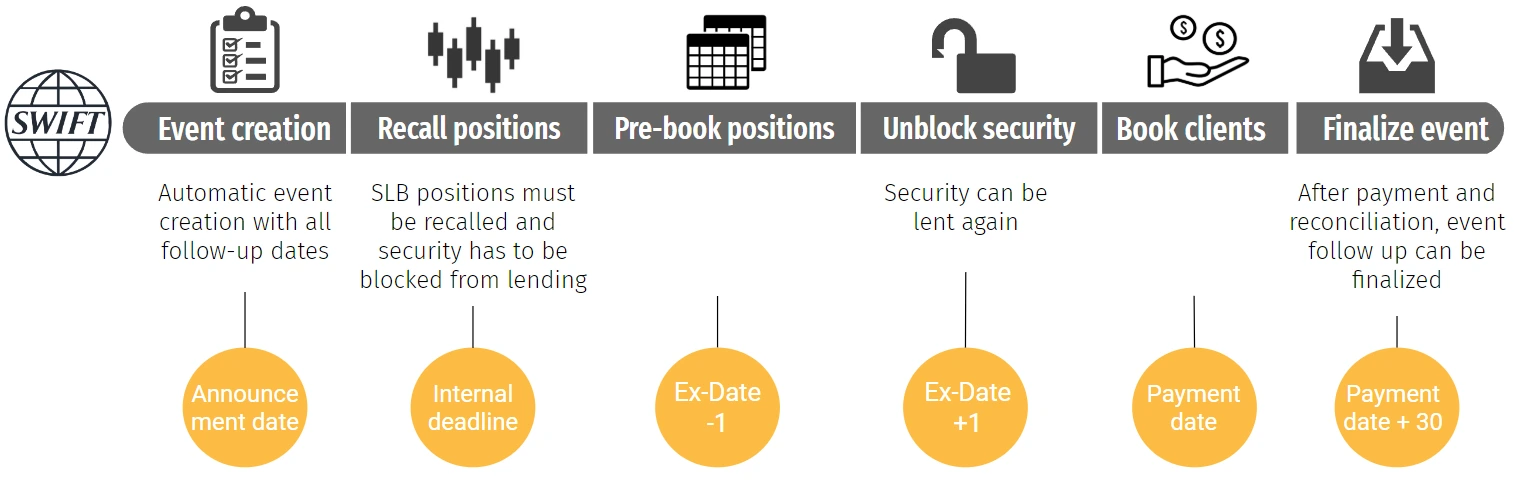

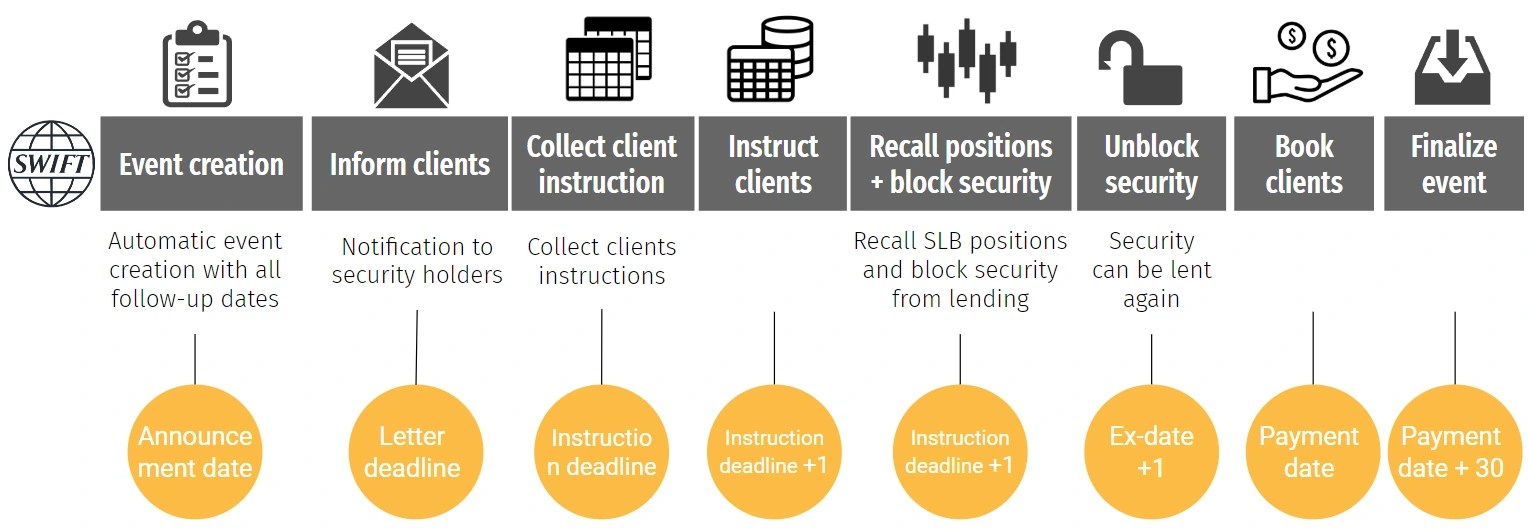

How can automation improve your process?

Let’s explore how Business Process Automation (BPA) can transform the way you handle corporate action events