First Impressions Matter: Begin Your Banking Journey with us

A smooth and quick customer onboarding process wins the trust and loyalty of the customer. Establish a new bank account for a client, providing necessary documentation such as identification, proof of address, and other required information, and completing any additional formalities

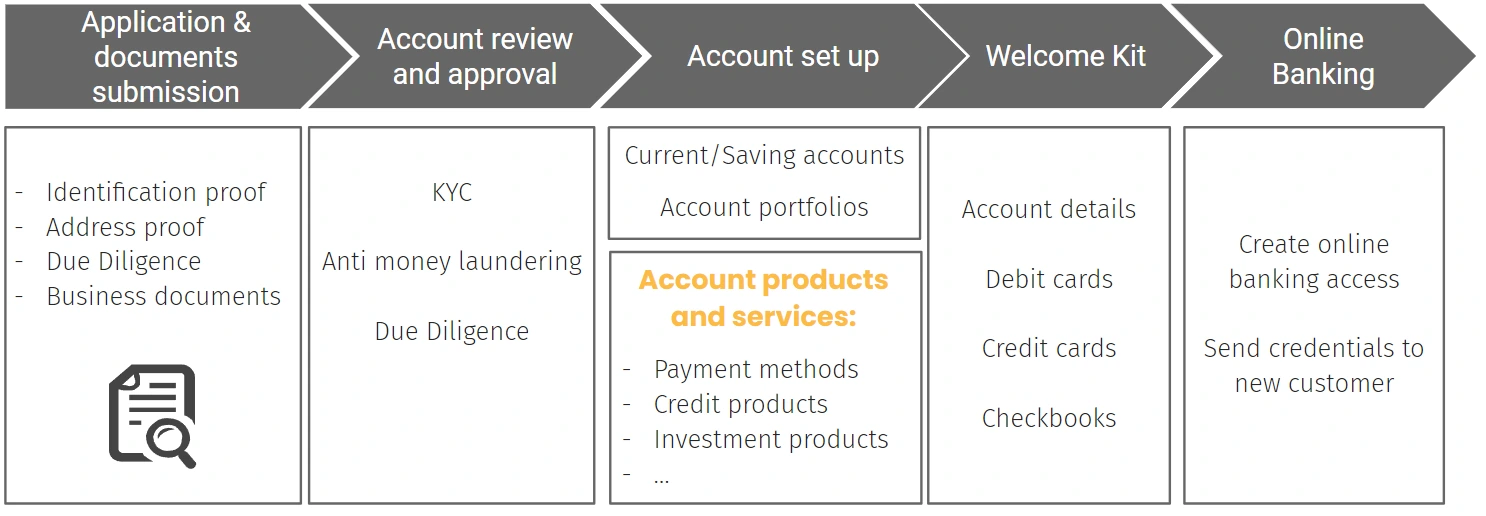

Understanding the process

Account Opening is the process of establishing a new banking account, whether it’s a savings account, checking account, or any other financial product. It involves gathering customer information, verifying identities, selecting account options, and completing necessary paperwork to activate the account. Effective account opening ensures that customers have access to the banking services and products that best suit their financial goals and needs.

Steps in the process

How can automation improve your process?

Traditional banking institutions rely on manual procedures to collect and authenticate customer data. Contemporary banks utilize digital channels such as websites, mobile apps, and third-party platforms for gathering customer information and avoid the risks of suspicious customer activities that can compromise a financial institution.