Your Funds, Swiftly Delivered

Approving funds transfers quick and efficiently is crucial for maintaining customer satisfaction and ensuring compliance. At Automize Infinity, we help financial institutions optimize their funds transfer approval processes through Business Process Automation (BPA).

Understanding the process

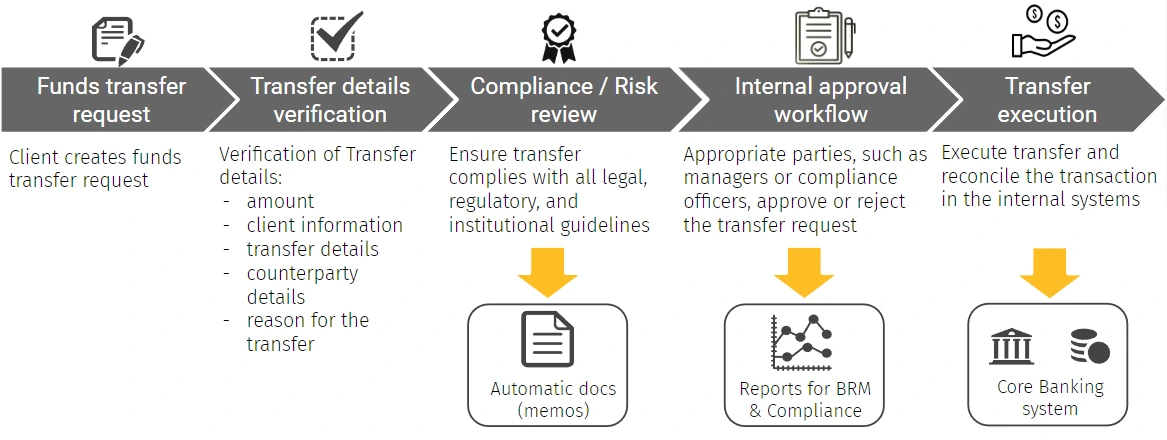

Funds transfer approval is the process by which financial institutions review and authorize the movement of funds between accounts, whether between customers or between different institutions. This process is vital for ensuring the security, compliance, and accuracy of the transactions, especially in high-value or cross-border transfers.

The approval process ensures that the transaction meets all internal policies, regulatory requirements, and security protocols before the funds are disbursed. This reduces the risk of fraud, errors, or unauthorized transactions while maintaining operational efficiency.

Steps in the process

How can automation improve your process?

With BPA automation, you can enhance accuracy, speed, and compliance, while reducing risks and costs. Our customized solutions are designed to streamline your processes, reduce manual effort, and improve the overall client experience.