Your Assets, Transferred with Confidence

Securities transfer is a crucial process in the banking sector, requiring precision, speed, and compliance to ensure smooth transactions. At Automize Infinity, we specialize in automating the securities transfer process, helping banks enhance efficiency, reduce risks, and improve the overall client experience.

Understanding the process

Securities transfer is the process of moving ownership of financial assets, such as stocks, bonds, or mutual funds, from one party to another. It involves updating the ownership records and ensuring the secure and compliant transfer of assets in line with the regulations. This process is often triggered by events such as the sale or purchase of securities, inheritance, or the movement of assets between accounts or institutions.

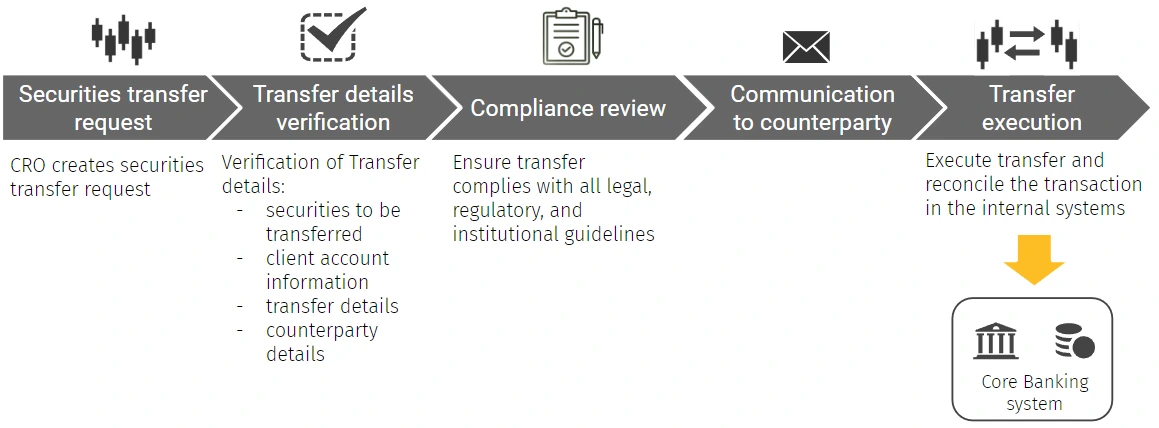

Steps in the securities transfer process

How can automation improve your process?

Our tailored BPA solutions empower financial institutions to automate and optimize the securities transfer process, driving operational efficiency, reducing risks, and ensuring a better experience for your clients.